Liveblog of Civic Media Lunch w/ Ann Larson and Aaron Smith, two of the organizers of Strike Debt. Blogged by Erhardt Graeff and Rahul Bhargava.

Nice to be here on May Day, May 1st—international worker’s day, starts Ann Larson before she starts their argument: Debt resistance is well-suited as a political tactic. Debt is not autonomous, it exist as part of an economic and political system. A recent study that claims the US is an oligarchy, not a participatory democracy. How do we begin to change that dynamic, how do we begin to develop counterpower?

Ann and Aaron Smith are here to introduce a bit of background, talk about how Strike Debt got to where it is, focusing on student debt as an illustrative example. Then they’ll share some of their projects and interventions: Debt Assemblies, Rolling Jubilee, and the Debt Resisters Operations Manual.

Background

They share that almost all of us are in debt: almost 3/4 of americans have some kind of debt, not from luxury items or expenditures, but from everyday costs. 62% of all bankruptcies are caused by medical illnesses. The rate of medical bankruptcy has not even decreased in progressive Massachusetts. Over $1 trillion in tuition debt in the US. 1 in every 7 americans is being pursued by a debt collector.

Debt affects various people differently. For instance, African Americans have lost 50% of their collective wealth since 2007. This was largely due to losses from the foreclosure crisis, where the African Americans community had built up their wealth. Underbanked families spend 10% of annual income on alternative financial services: payday loans/lenders, etc. Student debt defaults are now occurring at the rate of one million per year.

We like to think of debt as part of a web, a web that catches you such that as soon as you pay off one loan you are indebted for another reason, often medical emergencies.

Why are we in debt?

A number of reasons. Wages have remained stagnant since the 70s. We are in a period of steep austerity. The burdens of paying for individual needs are being shifted onto individuals, like in the case of public higher education funding and tuition hikes. Debt is like a mortgage on your future. The debt-price spiral is to cause as well, wherein more financial innovations occur (like mortgage-backed securities) meaning the price of the good has dramatically outpaced inflation. The offered solutions right now are market-oriented ones. These individualize the problem and create new markets.

We are living in a new gilded age. Thomas Piketty’s new book makes this argument in a particularly clear way: the rate of return on real capital exceeds the actual growth rate. 95% of income growth in the economy accrues to the top 1% of households. Growing inequality is an inherent priority of a system with debt.

Student Debt

Strike Debt came together in 2012, many from Occupy Wall Street, debt was one thing we had in common. They discussed the ways debt, especially student debt, had changed the course of their life: kids, careers, etc.

Over $1 trillion in debt and rising. Tuition is rising exponentially (500% since 1980s). States are disinvesting in higher education. Debtors accrue debt while in school but they don’t begin to pay until after they leave college, i.e. you may not know you are in debt while accruing it. Student debt is confusing: lenders, servicers, guarantee agencies. People don’t always know whom they owe. No bankruptcy protections for federal or private loans and serious consequences for default. About 1 in 6 student debtors is already in default (about 7 million people).

Srike Debt see government response as inadequate. They lowered rates for one year. President Obama hasn’t offered a real plan – he proposed linking federal funds to employment outcomes.

They think Elizabeth Warren’s plan sounds pretty weak: allowing current student debtors to refinance their loans at US treasury interest rates. But the CBO estimates that, under that model, in 2016, the interest rate on student debt will be above 6%, about where it is now.

In fact, the government is making $127B per year off students – this is a profit center for the government.

They argue that all public 2- and 4-year colleges could be free. Total tuition was $60 billion in 2010-11. In that year, the Federal government spent at least $37B on tuition / student debt subsidies (including tax deductions student loan interest paid). Government spends an additional $10B on aid for predatory, for-profit institutions. The $11B gap is less than tax subsidies to just 12 corporation.

Projects

Strike Debt are publishing articles about how to find leverage against the student debt system. But debt assemblies were their first project, or form of action. Debtors came together in Zucotti Park, and in Oakland, and so forth in other cities.

Aaron admits that he thought the debt assemblies were “hokey.” But when he was standing with others in Washington Square Park, he saw that everyone had a personal story to tell. While everyone has this debt, you don’t think you have a common interest together, but when you share those stories with others you create community and a site of common resistence when you realize your auto debt, student debt, home debt, etc. are all going to the same places.

The Rolling Jubilee looked at debts in default, which were sold to debt buyers/collectors for pennies on the dollar. We created a public education campaign by creating an entity that could invest in the secondary market. We purchased medical debt and cancelled it. We raised over $700,000, which was able to cancel over $15 million in debt. We haven’t yet been able to purchase student debt because it is guaranteed by the federal government so it’s not sold on the secondary market.

Rolling Jubilee Telethon was in November 2012

They called it the People’s Bailout. They weren’t sure if people would give money to the campaign, so they only asked for $50,000 (they met their goal in the first 48 hours of going live), allowing them to cancel $1 million of debt. You can read about all the debt purchases on the website, details of how many debtors and total amount of debt. They show the closing statements offered to debtors, which look like technicalities but of course are about real people and their debt.

Organizers like Aaron and Ann show the Rolling Jubilee, audiences like this wonder how to scale and buy all the debt. But this can’t scale – there is $1 trillion of debt traded on the secondary market every year. Your individual debt is essentially worthless. The lender didn’t expect to collect the full value, so morally you shouldn’t feel the need to pay it all, the argue.

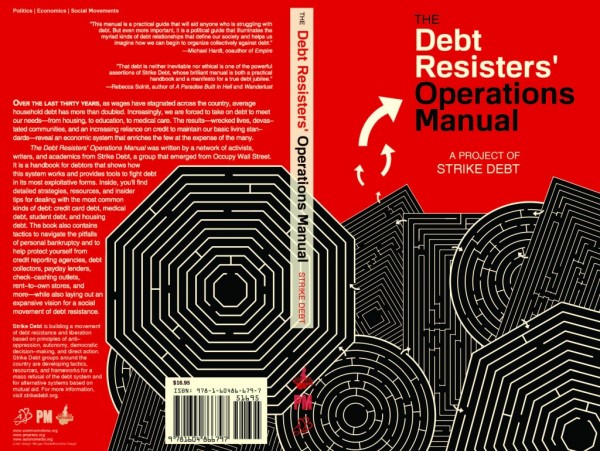

The Debt Resister Operations Manual is the material for having a different kind of conversation with the debt industry.

“To the financial establishment of the world, we have only one thing to say: We owe you nothing. To our friends, our families, our communities, to humanity and to the natural world that makes our lives possible, we owe you everything” – from the Debt Resisters’ Operations Manual

The book is available online. The manual includes information about different kinds of debt and how to use bankruptcy as a strategic tool. More than a manual it also moves us toward thinking about debt as a collective problem, especially in the later chapters.

Strike Debt are building out a network of debt resister chapters across the country. They also created the “Death by For-profit Health Care” report.

“Shouldering the costs: who pays in the aftermath of Hurricane Sandy” is another piece of analysis published on their website looking into the debt servicing people affected by the hurricane that was damaging local businesses rather than rebuilding the local economy and community. They are working to build out cooperative debtor communities rather than leaving victims to predatory lenders. This report was used by the state attorney general in evaluating the aftermath of Hurricane Sandy.

Collective Action Against Debt

Next up for Strike Debt is collective action against debt. Organized debt refusal is not unprecedented. Internationally, El Barzon in Mexico and citizen debt audits in Europe have been successful. In Ohio, there is ESOP engaging in a mortgage strikes.

Student Loan Asset Backed Securities (SLAB) collect pieces of many accounts in single securities, then large institutions underwrite those and sell them. This allows lenders to loan the money and have no risk because they can cut it up and sell it all off. People in a single SLABS can be distributed across the country, which makes it hard to organize them.

“If you owe the bank $100 that’s your problem. If you owe the bank $100M , that’s the bank’s problem” – J. Paul Getty

Since we collectively owe the banks hundreds of billions of dollars, it should be their problem.

Strike Debt is in the process of building a browser plugin to scrape student loan websites (like FAFSA). They want to combine with back-end data on SLABS (order of 10,000 accounts/each), and link it to financial institutions.

What does collective action against student debt look like?

A “debt boulder” made up of several debt notices and used like pinata.

readyforzero.com scrapes all the debt for an individual and offers a payment plan (though unrealistic). They want to connect the aggregation capabilities of readyforzero.com with student loan securitization data and information to illuminate whom you actually owe debt to.

If they can take each SLABS and then get them all to default at the same time, or threaten to, or maybe send that money into escrow, this could threaten the rating of that security, on which the large bank depends. The goal is to change these bonds of debt into leverage.

Aaron and Ann ended with this quote from Andrew Ross that embodies their work:

“When a government cannot protect its people form the harms inflicted by rent extractors, and when debt burdens become an existential threat to a free citizenry, then the refusal to pay back is a defensible act of civic disobedience. for those aiming to reinvent democracy, this may be nothing short of a responsibility.” – Andrew Ross in Creditocracy

Question & Answer

Andrew Whitacre: The mechanisms of demand inelasticity mean that young people can’t not get a college degree anymore, allowing universities to jack up tuition prices… [missed end of question].

Ann: We are trying to think about how to collectivize. Buying debt is not a way we can take on the whole system. How can we act together to change the central dynamic between debtors and lenders. Can we flip the script about being a bad person if you can’t pay? Maybe it’s the lender that is morally at fault or is charging 20% on payday loan that is to blame?

Sasha Costanza-Chock: In Boston there is an organization called City Life Vida Urban. They are working together to keep people in their homes. They work with Harvard Law School and others to keep hundreds of people in their homes across Boston, especially people of color. We worked with them on Change the Game…. Question: Let’s say you organize 1 million people to participate debt resistance, what does that look like and what do they demand?

Ann: We’re not sure what it looks like. There is an “invisible army” of people who are already defaulting on debt. I think one of the things we don’t want to do is have this big idea and tell others what to do. We want to tell people about the others around them in similar problems and make connections and collectives that can come together and work on the issues in unison.

Aaron: Rather than creating a specific set of demands, you are introducing a new power dynamic. The debt financing of individual needs could be changed.

Jim Paradis: Do you have any financial institutions interested in working with you on these problems? I imagine at some level government or financial institutions would be interested in creating a dialogue, i.e. how can we work together on types of debt that aren’t exploitative. Any dialogue there?

Aaron:The Consumer Financial Protection Bureau reached out to us when we got the Rolling Jubilee started. It’s a brand new agency. They are going after payday lenders and student lenders. There are couple of hitches in working with them though: being connected to Occupy Wall Street means agencies can’t work directly with us. We’ve had politicians come up to us and say what we are doing is great, but they couldn’t say that out loud because it would mean the end of their political careers.

Matt Carroll: What would you like lending to look like in the future?

Aaron: I don’t have a particular model in mind. We see a model that has crowded out the possibility of other models. Zizek said “It’s easy to imagine the end of the world. An asteroid destroying all life and so on. But you cannot imagine the end of capitalism.” The existence of debt has suffocated people such that they can only think about paying off their debt. We are not about prescribing a particular form of resistance, but finding ways to give people breathing room.

Patsy Baudoin: Where is your data from? Where are you sourcing that information.

Aaron: Sources are linked on rollingjubilee.org; it’s all openly available data. It’s mostly government data, and there is one Citibank report we used.

Saul Tennenbaum: At some level debt becomes investment; when you go up the class structure you are no longer in debt, you’re “invested….” Question: You want to do collective action in abstract networks, but you focus on student debt. Why did you choose one rather than the other?

Aaron: Rolling Jubilee emerged from the Occupy Student Debt Collective. They were going to submit a pledge to get 1 million people to default on their debt. They only got 8000. People were worried and afraid. That led us to think more about targeted strategies. Working through SLABS diffuses the responsibility on any particular debt resister.

Ann: We like to think of debt as a “choke point” for blocking debt.

Aaron: Blocking flows is a really important tactic.

Ian Condry: Is there a way to talk about legitimate debt and illegitimate debt? Are there ways to get the priorities conversation going? The bankers could argue “this SLABS is your Grandma’s 401k.”

Aaron: I think that goes back to the Gilens and Page study that Ann talked about before. The idea of taxing the 1% in any way is not going to happen, and cutting the military is another possibility but there might be other democratic approaches to take.

Ed Platt: Have you thought about the role credit uions play in this movement? And if you take all the people in or near default, and cut their interest rates, they might be able to pay—what are the main obstacles preventing that now?

Ann: You need a mass social movement to deliver it.

Aaron: They don’t know each other right now though, that’s the part of revealing the webs. As for the credit unions, we are talking to many but haven’t found a specific way to work together yet.

Harvard Law School Student involved in their Predatory Lending Clinic: A lot of folks don’t know that debt can be renegotiated. Your posters are great. I’m curious about flipping the morality that you “have” to pay your debt.

Ann: One of the things that happened after launching Rolling Jubliee, we received 1000s of emails and didn’t have the people power to respond to them, offering personal stories of debt. The releasing of shame was a huge theme of those emails. They were so pleased to feel like they weren’t at fault anymore. We didn’t know how to share them—we can’t publish them since they were sent in confidence.

Aaron: A lot of the emails asked us to buy their debt, but that’s not how it works. Most of the emails included details about why they should be paid off, making the case about how they are exceptional. But that’s the problem, they aren’t exceptional, so many are affected by this. We also are working with an NYU law student brainstorming how to start debt clinics.

Andrew Whitacre: [missed question]

Aaron: We try to avoid being a clearing house, because we are only a handful of volunteers. Spreading the word and helping start local groups is what we think is the best we can do.

Yu Wang: How do you think about the credit report?

Ann: Credit reports are a real weapon of the credit industry. There is fear that a “black” mark will hurt your ability to buy a home, or even get a job (if your employer pulls your credit report). We would like to include the demand that you can’t be hit on your credit report for unfair practices against you.

Rahul Bhargava: I have a question about strategies. It sounds like you are trying to solve an information asymmetry problem, and just let others do actions on top of that information. In contrast to Rolling Jubilee, you served as a central node of action. People here in the Center for Civic Media are good at solving the information asymmetry problem, so that could be an important conversation topic.

Sasha Costanza-Chock: Linking people who are terrified and ashamed to stories of people like them who have taken action seems really important. How do you organize people who do succeed in addressing their needs to be organizers and mentors to others? I.e. How do you scale your work beyond your small group of people?

Aaron: That’s a hard problem that we haven’t solved yet.

Jason Haas: I think the story sharing component is really important to the moral power of the movement. “Why it’s moral to resist” is a complicated calculus. You need stories to convince people why it’s moral.

Rahul Bhargava: Harry Potter Alliance is really good at that!

Aaron: We’ve had some books come out. We’re trying to create the conversation about a different morality.

Sasha Costanza-Chock: Can you talk a little more about “Jubilee” as a rhetorical and organizing idea?

Ann: You can read Debt: The First 5,000 Years and you’ll see that Jubilees happen all the time. Debt was forgiven every 7 years in the ancient world. Jubilees are meant to stabilize relations between debtors and lenders, although the economic classes would stay the same. I believe it is inevitable that we will have a student debt jubilee, because it’s impossible that $1 trillion of student debt will be paid off.

Saul Tennenbaum: We still have Jubilees all the time: GM and City of Detroit are having debt jubilees right now. We just don’t call them that.

Erhardt Graeff: What do you think are the best ways to mobilize current students? You talked about campus-based chapters, and helping students realize they are going into debt now.

Ann: I’m a student-debtor. I didn’t really know what it was going to mean to me. This is how you finance college. 10 years later I said “Wait a sec, what did I do?” Debt is abstract and in the future, so nobody talks about it. We have lots of examples of student mobilizations (Chile, Quebec). The supporters in the streets fighting against tuition hikes. But we don’t see much of that in the United States.

Aaron: There is a convergence happening in Montreal soon. These are the beginnings of a growing movement.

Erhardt Graeff: I’d love to see Strike Debt tables next to the credit card sign up tables at college orientation.

Aaron: This happened at NYU this year. They created different pamphlets and “dis-orientation” materials.

Harvard Law School Student: At the Law School, you either have students that don’t think about debt at all or those that think about it and leads them to safe career choices. People would love to do the right thing but they have student debt. And the pathways are so easy to you to pay off that debt (big law firms). We try to have conversations with people about what they would do if they didn’t have student debt.